At ATCA Insurance Brokers all of our products rigorously comply with the rating required by the USA for insurance companies.

What and which are the Rating Agencies?

Rating agencies are independent companies that analyze the credit quality of different issuers (both public and private entities).

The best known rating agencies are Moody’s, Standard & Poor’s and Fitch IBCA, and the defining characteristic of all of them is that they do not hold risk positions or interests in the markets and do not belong to any group that acts in them. His job is to analyze everything from the economic situation and the business environment to the financial statements in detail, the company’s risks, the business and even the quality of management.

Another rating agency isA. M. Best, which specializes in rating insurance and reinsurance companies.

How are agency ratings obtained?

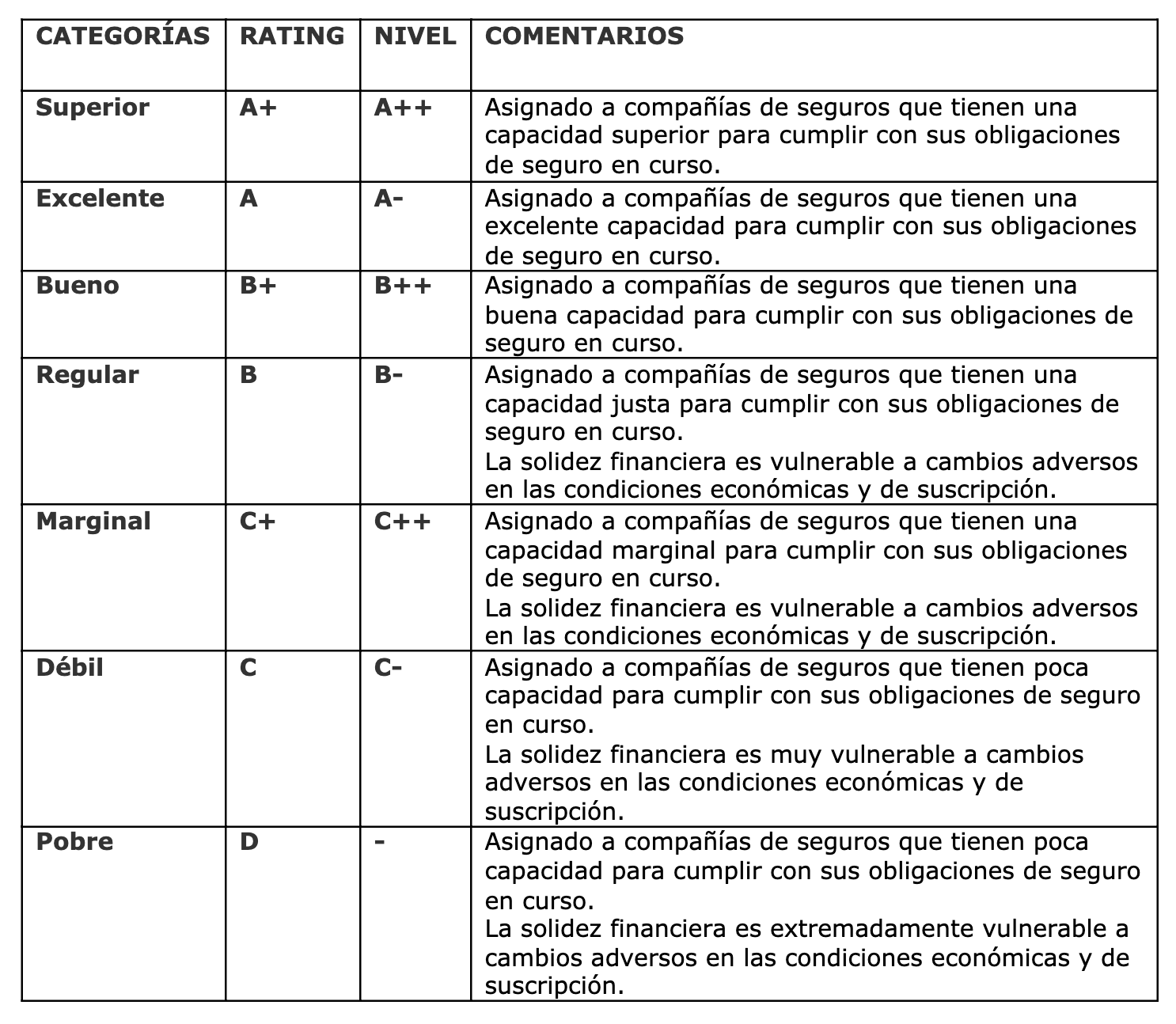

There are long-term and short-term ratings. In the following tables you will find details of each of the levels.

These ratings are not static; they may change depending on market circumstances or the company’s creditworthiness.

The aforementioned rating is granted by independent agencies that analyze the credit quality of companies. In their ratings they use letters sometimes accompanied by + / – or the numbers 1, 2 and 3.

Qualifications of A. M. Best

How do I know what is the rating of the insurance company with which I have taken out my insurance?

In the U.S. visiting professor program, the visiting professor is required to fill out a form indicating the rating of the company with which he/she has taken out insurance.

At this point, when you request the rating of the Insurance Company with which you contract your insurance, they must provide you with information compatible with the US requirement regarding the insurance contracted. Specifically, the information they request is:

Regarding the “Claims paying ability rating”, the minimum levels must be met. In addition, they require AM Best, Fitch, Weiss Research, Standard and Poor’s, Moody’s, and the AM Best Agencies.

All of them have international prestige and recognition, and also require minimum qualifications for each agency. For example:

We are required to have the Insurance Company rated with an “A” or above by AM Best (“A.M. Best Rating of “A” or above”).

We require the insurance company to have a rating of “A3” or higher if its creditworthiness has been rated by Moody’s Agency.

(“Moody’s investor services rating of “A3” or above”)

Or they ask us for an “A-” or higher if Fitch Rating has rated the Insurer. (“Fitch Rating, Inc. rating of “A-“ or above)

To give just a few examples of how we should interpret theclaims paying ability rating requirement.

Therefore, our Insurer must provide us with the Rating that it has by one of these companies admitted by the USA.

Real examples of real ratings of Insurance Companies in Spain:

If what the Insurer indicates is a figure accompanied by a % (125%, 236%…) they ARE NOT INDICATING THE RATING, but their solvency ratio. They do not indicate any rating agency as they are Companies that have not been rated by Fitch, Moody’s, AM Best, S&P’s or any other rating agency admitted by the United States of America.

Therefore, they would not be complying with the U.S. requirement regarding the qualification of the insurance company with which the visiting teachers’ insurance is contracted.