"*" indicates required fields

"*" indicates required fields

Este sitio web utiliza cookies para que usted tenga la mejor experiencia de usuario. Si continúa navegando está dando su consentimiento para la aceptación de las mencionadas cookies y la aceptación de nuestra política de cookies, pinche el enlace para mayor información. ACEPTAR

No, the travel insurance covers you from the first day when the start date of the insurance and the date of travel coincide. There are companies that accept the contracting of the insurance when the trip has already started or you are at your destination, but they may apply a waiting period (72 hours in many cases).

We travel more and more frequently and for longer periods of time, for work or leisure, within our country or abroad, to faraway, exotic places… Traveling means disconnecting, enjoying, forgetting about routine, and all of this can come crashing down due to a small setback. When we travel, incidents or unforeseen events may occur that are difficult to solve if we do not have the appropriate means.

It is therefore always advisable to have the protection of travel insurance to be covered for any problems that may arise at your destination,as it includes medical and assistance guarantees during your stay abroad.

For this reason, and in order to help you make your trip a success, we offer you a wide range of products with which you can choose the one that best suits your needs.

A travel insurance provides you with 24-hour medical assistance abroad without having to pay any money upfront.

In addition to 24h medical assistance, it also includes coverage for theft and luggage damage, delays or last minute cancellation of transportation, repatriation and evacuation, early return in case of hospitalization or death of a family member, travel of a family member in case of hospitalization or death of the insured, civil liability and legal assistance…

The travel insurance covers medical expenses resulting from sudden and unforeseen illnesses(flu, otitis, appendicitis operation…)or accidents (fractures, cuts, burns, sprains…).

TRAVEL INSURANCE IS NOT HEALTH INSURANCE FOR EXPATRIATES. The difference is that the latter will cover things that you may not need: expenses related to pregnancy and childbirth (a medical insurance will cover this after a waiting period of 8 – 10 months generally), pre-travel illnesses, optical or dental expenses (expatriate medical contracts usually offer very limited guarantees), regular visits, check-ups, vaccinations…

Depending on your needs and the type of trip to be made, you can contract different travel insurance options, from policies with very complete coverage, others that allow you to customize it to your needs, to more economical insurance to cover the essentials.

One of the requirements to enter the PPVV program in the USA (Spanish nationality, B1 level of English and a long etcetera), is to obtain a J-1 visa.

The J-1 visa is a short-term nonimmigrant visa issued by the U.S. for international visitors. Allows certain individuals to enroll in work-study based exchange programs to teach, study, conduct research or receive job training in the U.S.

Their spouses, children or other dependents may travel on a J2 visa.

J-1 visa holders and any J-2 visa dependents (spouses and children under 21 years of age) accompanying them must have health insurance with the minimum benefit levels set forth in the program regulations. The insurance must cover medical expenses for evacuation and repatriation.

You should check with your Sponsor for the appropriate medical insurance requirements. These are the ones who verify that the health insurance complies with the regulatory requirements. Willful failure on the part of the participant and/or his/her J-2 visa dependents to maintain active insurance coverage is grounds for termination from the program.

At ATCA Insurance Brokers all of our products rigorously comply with the rating required by the USA for insurance companies.

What and which are the Rating Agencies?

Rating agencies are independent companies that analyze the credit quality of different issuers (both public and private entities).

The best known rating agencies are Moody’s, Standard & Poor’s and Fitch IBCA, and the defining characteristic of all of them is that they do not hold risk positions or interests in the markets and do not belong to any group that acts in them. His job is to analyze everything from the economic situation and the business environment to the financial statements in detail, the company’s risks, the business and even the quality of management.

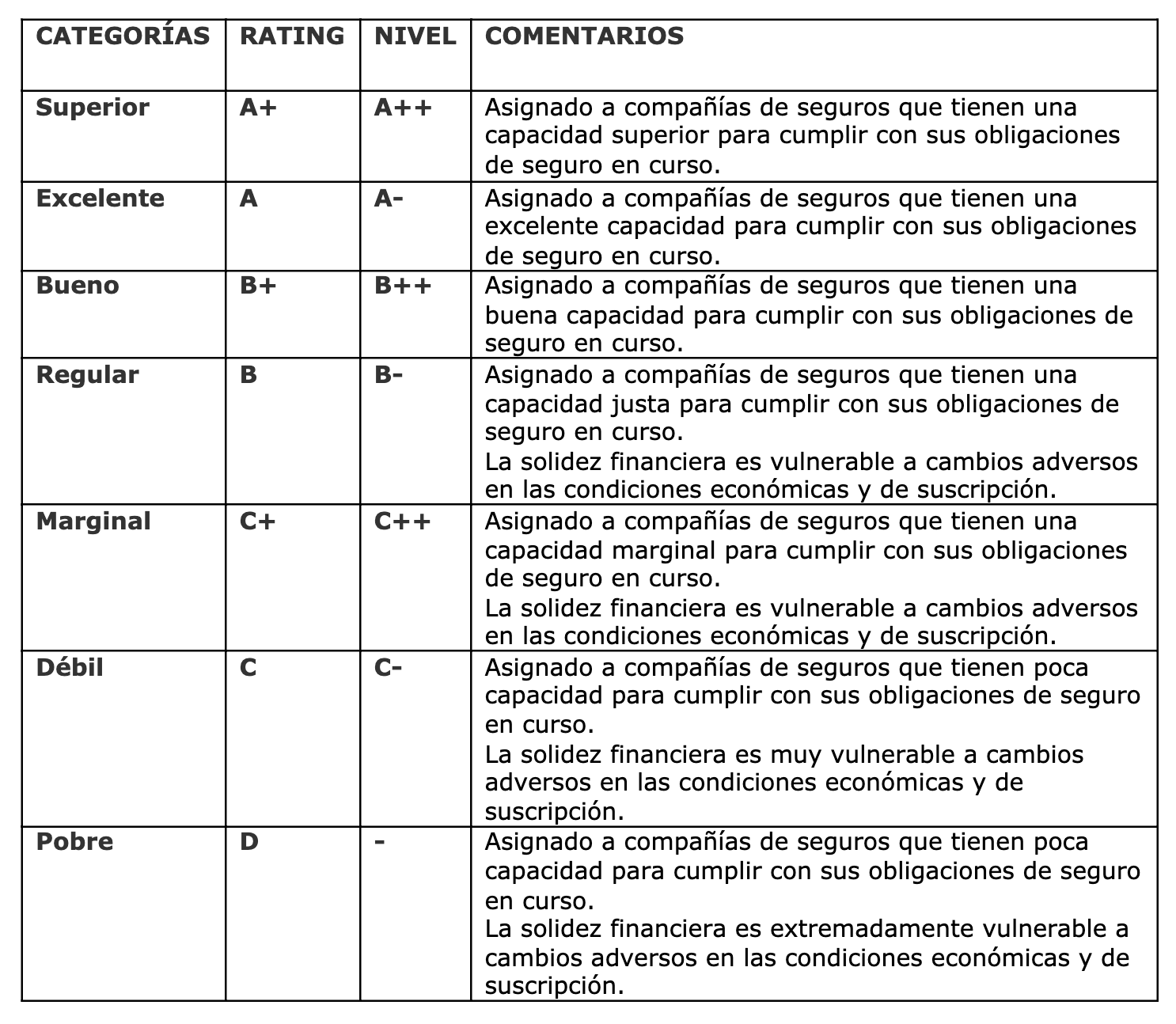

Another rating agency isA. M. Best, which specializes in rating insurance and reinsurance companies.

How are agency ratings obtained?

There are long-term and short-term ratings. In the following tables you will find details of each of the levels.

These ratings are not static; they may change depending on market circumstances or the company’s creditworthiness.

The aforementioned rating is granted by independent agencies that analyze the credit quality of companies. In their ratings they use letters sometimes accompanied by + / – or the numbers 1, 2 and 3.

Qualifications of A. M. Best

How do I know what is the rating of the insurance company with which I have taken out my insurance?

In the U.S. visiting professor program, the visiting professor is required to fill out a form indicating the rating of the company with which he/she has taken out insurance.

At this point, when you request the rating of the Insurance Company with which you contract your insurance, they must provide you with information compatible with the US requirement regarding the insurance contracted. Specifically, the information they request is:

Regarding the “Claims paying ability rating”, the minimum levels must be met. In addition, they require AM Best, Fitch, Weiss Research, Standard and Poor’s, Moody’s, and the AM Best Agencies.

All of them have international prestige and recognition, and also require minimum qualifications for each agency. For example:

We are required to have the Insurance Company rated with an “A” or above by AM Best (“A.M. Best Rating of “A” or above”).

We require the insurance company to have a rating of “A3” or higher if its creditworthiness has been rated by Moody’s Agency.

(“Moody’s investor services rating of “A3” or above”)

Or they ask us for an “A-” or higher if Fitch Rating has rated the Insurer. (“Fitch Rating, Inc. rating of “A-“ or above)

To give just a few examples of how we should interpret theclaims paying ability rating requirement.

Therefore, our Insurer must provide us with the Rating that it has by one of these companies admitted by the USA.

Real examples of real ratings of Insurance Companies in Spain:

![]()

If what the Insurer indicates is a figure accompanied by a % (125%, 236%…) they ARE NOT INDICATING THE RATING, but their solvency ratio. They do not indicate any rating agency as they are Companies that have not been rated by Fitch, Moody’s, AM Best, S&P’s or any other rating agency admitted by the United States of America.

Therefore, they would not be complying with the U.S. requirement regarding the qualification of the insurance company with which the visiting teachers’ insurance is contracted.

Title 22 Code of Federal Regulations, Part 62.14 states that all J visa, J1 visa and J2 visa holders are required to be beneficiaries of health insurance that meets at least the following requirements:

All our insurances comply scrupulously with the J1 and J2 visa requirements.